mission and Vision

My vision is to empower 10,000 parents by 2028, helping them spend quality time with their loved ones without money worries through the AngPao for Life method.

It is my mission to educate and guide financially worried parents, providing them with the 5S method and the right financial tools to instill harmony among their family members for generations to come.

Through empowerment, service with integrity, and harmony—I help parents by maximizing their money, giving them financial confidence and peace of mind.

Ways We Can Work Together

Financial Planning Solutions

Helping you define and prioritize their financial goals, such as retirement planning, saving for education, or buying a home.

Angpao For Life Coaching

Achieve a balanced life and be fully present with your loved ones while managing your financial wealth. Whether you are just starting out or looking to enhance your existing financial knowledge, this is designed to meet your needs.

Little Boss Camp

A program that helps kids ages 9-18 discover their passions, develop confidence, master money management, and even craft winning businesses — all in a fun, engaging way!

Speaking Engagement

Every company and its employees have unique needs. Whether you want to address financial stress, encourage saving habits, or foster a culture of entrepreneurship, I can customize my talks to align perfectly with your company's goals.

Testimonials

Grab your FREE Angpao For Life Calculator

Discover how much you need to save to secure a financially free life for yourself and your family.

MEET THE FOUNDER & CEO

Hi! I'm Sheila

Cash Flow Certainty Coach, Registered Financial Planner, Certified Scale-up Coach, Certified Kidpreneur Coach, and International B.A.N.K. IOS Coach.

My passion lies in empowering entrepreneurial parents to achieve financial freedom, allowing them to spend quality time with their children without the burden of money worries.

This vision led me to create Ang Pao for Life, a transformative system designed to make this dream a reality.

Teaching Kids to Be Money Smart

Discover three simple tips to help your kids become money smart! From gifting ang pao wisely to teaching saving habits, start building their financial confidence today. Join the AngPao for Life commun... ...more

Money Smart

September 03, 2024•5 min read

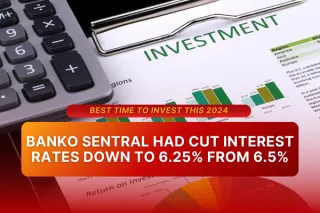

Banko Sentral had cut interest rates down to 6.25% from 6.5%

Learn how Banko Sentral's interest rate cut to 6.25% from 6.5% makes 2024 the best time to invest. Discover top investment opportunities in a favorable financial climate. ...more

Investment Fund

August 25, 2024•1 min read

One in 100 Filipinos Have Autism: Why Early Health Protection Matters

Explore why 1 in 100 Filipinos have autism and how early health insurance can protect your child from rising medical costs. Discover the benefits of investing in HealthFlex for your child's future. ...more

HealthFlex

August 24, 2024•2 min read

JOIN TO MY FREE COMMUNITY

CONNECT WITH ME

Copyright © Sheila Ching-Ong. All rights reserved.

Website Design by Joanna Ching

This website is not affiliated, associated, authorized, endorsed by, or in any way officially connected with YouTube, Facebook, or any of their subsidiaries or affiliates.

Affiliate Disclosure: The owner of angpaoforlife.com may receive an affiliate commission for some of the products recommended or featured on this site. However, any endorsements made on this site are based on the author's personal opinion from actual use or interaction with the product or service. The owner is not a paid spokesperson for the manufacturers or service providers and seeks to provide honest reviews and insights.

EARNINGS DISCLAIMER: The performance and results discussed on this website, including examples of income and sales figures, are those of the website owner and/or other individuals who have provided testimonials. These results are specific to the individuals and are not intended to represent or guarantee that anyone will achieve the same or similar results. Success in any endeavor is based on numerous factors unique to each individual. We do not claim that the products or services offered on angpaoforlife.com can guarantee any specific outcomes or results, including financial gains. As with any business, your results may vary and will be based on your individual capacity, expertise, and level of desire. There are no guarantees concerning the level of success you may experience.